Category: Starting a Private Practice

Efficient Use of Adwords

If you haven’t yet begun using Google Adwords for your private practice marketing, you should consider starting. I have found that this is one of the most efficient ways to market a practice. Unfortunately, in a crowded market, this can become very expensive. Some keywords maybe $25, $50, or more per click.

The key to efficient use of Adwords is using “longtail keywords.” These are more descriptive keywords than “shorttail” keywords, such as “mental health therapist in Los Angeles” as opposed to “therapy.” You read that right, a “keyword” might be more accurately called a “key phrase,” but in the field of digital marketing, these are all called “keywords” regardless of the number of individual words it contains. These longtail keywords are much cheaper and more targeted than the shorter ones. There are fewer searches for these keywords, which may seem to lead you to fewer visitors. That may be true, but when you are paying for each click, you want the most qualified “leads” possible (meaning patients searching for treatment, rather than people searching to learn more about what therapy is in general.

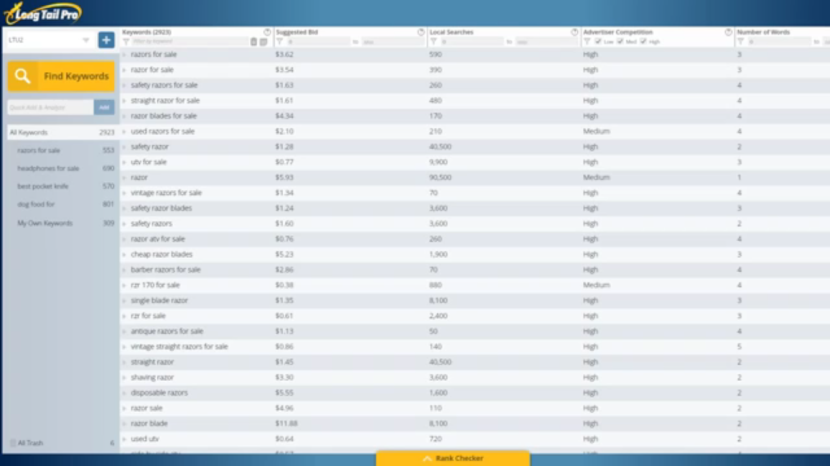

One free way to find good keywords is using Google’s Keyword Research Tool, a component of Google Analytics. A more powerful tool is Longtail Pro, which allows you to view the competition for each keyword. Competition is directly proportional to the cost of keywords. Longtail Pro also allows you to see the search volume for these keywords, which can help you decide whether or not to use a specific keyword.

For a limited time, you can get a 10-day trial of Longtail Platinum for just $1. I like this program, because once you purchase it, there are no recurring fees.

Best of luck to everyone as you forge ahead with digital marketing!

Understanding Billing Codes

CPT Codes

CPT Codes are used for individual providers, such as those in private practice. CPT Codes are billed on the CMS-1500 Form, also called the “HCFA.” Even if you do not accept insurance, if a client has a PPO insurance plan, they may receive some reimbursement for services. For clients with PPO insurance, you may print a “superbill” which has the CPT code on the form. You may also provide a patient with a pre-printed CMS-1500 form, which are available on Amazon.

Here are some examples of CPT Codes, with sample rates:

| CPT CODE | DESCRIPTION | BILLING AMOUNT |

|---|---|---|

| 0 | none | $0 |

| 90792 | Psychiatric Diagnostic Evaluation (with Medical Services) | $300 |

| 90833 | ADD ON-30 Min Psychotherapy | $50 |

| 90837 | Psychotherapy 60 min (53+ min) | $180 |

| 90838 | ADD ON-60 Min Psychotherapy | $100 |

| 90839 | Psychotherapy (Crisis) | $340 |

| 97813 | Acupuncture with Electrical Stimulation – 15 Minutes | $50 |

| 97814 | Acupuncture with Electrical Stimulation – Additional 15 Minutes | $50 |

| 99205 | Psychiatry 60 min Follow-Up E&M | $300 |

| 99215 | Psychiatry 30 min Follow-Up E&M | $150 |

| G0434 | Drug Testing, EtG/EtS Urine Alcohol | $85 |

| G0434 | Drug Testing, Urine Drug Screen (DSC6309) | $25 |

HCPCS Codes

Facility codes, also known as HCPCS Codes, are used by hospitals, intensive outpatient treatment centers, and other facilities. These codes are billed on the UB-04 form. UB-04 Forms are also available on Amazon. Most private practitioners will not need to use the UB-04 or do any facility billing.

20 Questions To Ask Yourself When Starting a Business

Ask yourself these 20 questions to make sure you’re thinking about the right key business decisions:

1. Why am I starting a business?

2. What kind of business do I want?

3. Who is my ideal customer?

4. What products or services will my business provide?

5. Am I prepared to spend the time and money needed to get my business started?

6. What differentiates my business idea and the products or services I will provide from others in the market?

7. Where will my business be located?

8. How many employees will I need?

9. What types of suppliers do I need?

10. How much money do I need to get started?

11. Will I need to get a loan?

12. How soon will it take before my products or services are available?

13. How long do I have until I start making a profit?

14. Who is my competition?

15. How will I price my product compared to my competition?

16. How will I set up the legal structure of my business?

17. What taxes do I need to pay?

18. What kind of insurance do I need?

19. How will I manage my business?

20. How will I advertise my business?

Having a game plan that answers these questions will put you ahead of the pack. This exercise may also bring up questions about whether private practice is the right choice for you. Not everyone is cut out to work for themselves.

Private practice requires you to tolerate a certain amount of risk. If this risk/reward equation is not exciting to you, a more stable form of employment may be a consideration.

The First 3 Steps in Starting a Private Practice

I cannot count the number of times I heard: “just hang a shingle” when I was starting my practice. There are other parts of your practice to set-up before getting office space.

After making some accounting mistakes, I realized the best way to get started is with these steps:

1. Get a Tax ID Number

You do not need to be corporation to get started in your practice. Insurance companies and other entities will ask for your Tax ID number. Luckily, getting a Tax ID is very easy.

As a sole proprietor, you are basically just “you,” but you don’t have to give out your social security number when asked for identifying information on insurance forms. Even if you decide not to take insurance, various entities will request your Tax ID number. Patients who wish to get reimbursed will require SuperBills that need either your SSN or Tax ID. No one wants to give you their SSN, so get a Tax ID. Here is a link to get more info on the Tax ID. (and, as always, check with your attorney)

The other benefit of a Tax ID (or “EIN”) is that you can use it to start a business bank account, which leads us to Step 2…

2. Open a Bank Account for your Practice

Having a separate bank account for your business will make accounting much easier. When you are just getting started, you may think that putting money into your personal account will be easier. DO NOT do this, it is guaranteed that this will cause confusion down the road. Plan to run your practice like a business, and having a separate account will allow you to track the profits and losses of your practice.

All bills paid (office rent, phone lines, internet, business cards, etc.) should come out of this business bank account. Some banks will charge a fee if you don’t keep a high minimum account balance (e.g. $5000 average daily balance, or more). Your business account does not necessarily have to be a “Business Bank Account” with the bank. Any separate account will do (although they may not let you use your EIN if it is a personal account). The point is, keep your business money separate from your personal money.

3. Get a Business Phone Line

You need a phone where potential clients can call you. When you are just getting started, you can have calls to a Business Phone Number forwarded to your cell phone. This also helps you separate personal and business life. You can do this for free with Google Voice or for a toll-free number where you can also receive faxes, take a look at Grasshopper. (check with your attorney re: HIPAA compliance with these services).

You can set up these services to register your business phone number as the number that will be displayed on your caller ID.

Following these first steps will help you set up a business life that is separate from your personal life, financially, and time-wise.

You must be logged in to post a comment.